I’m once again evaluating potential FTSE shares to add to my dividend portfolio. Shares that pay a reliable dividend help to ensure my portfolio provides consistent returns. However, I need to look at more than just the dividend yield to know which shares make the best additions.

Today I’m considering one of the UK’s most well-known high street banks, HSBC (LSE:HSBA). Barclays has already proven profitable for me this year and I’m hoping HSBC can do the same via dividends.

Its 8% dividend yield is higher than the 6.8% industry average. Plus, a payout ratio of 53% means the dividend is well-covered by earnings so payments are likely to be reliable and consistent. This is a key metric to check when considering dividend shares.

Subdued growth

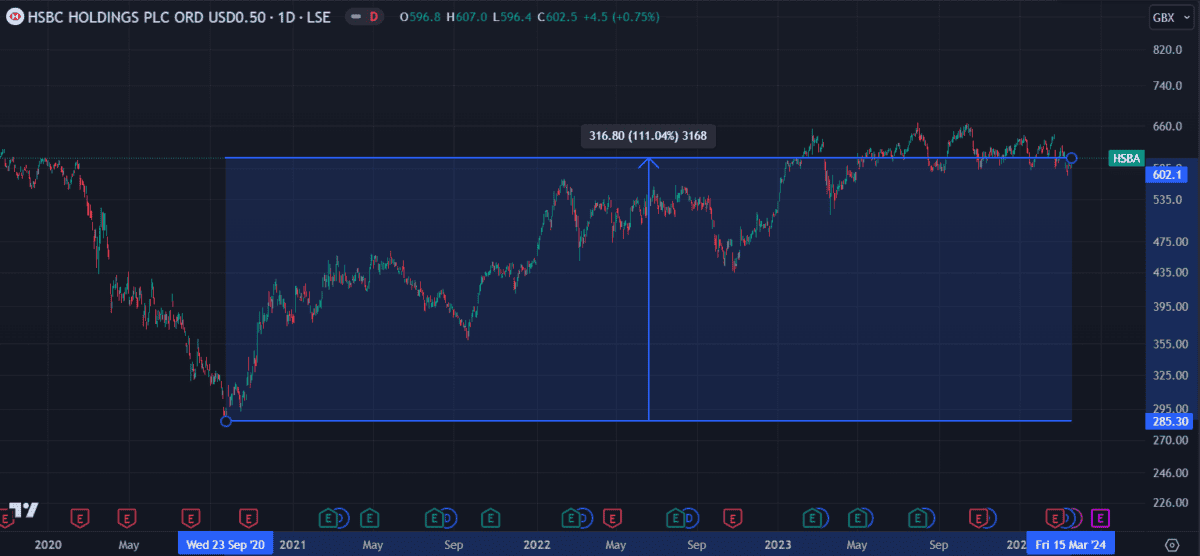

The HSBC share price has enjoyed only mild growth over the past four years from a low of 2.8p in late 2020. Now at 6p a share, it’s up 111% since then — but slightly down from a high of 6.6p in October 2023.

However, the most recent earnings report was not entirely positive. While revenue was in line with expectations, earnings-per-share (EPS) fell below analyst expectations by 13%. The subdued share price means forecasts estimate HSBC to be undervalued by 57%. This is supported by a low price-to-earnings (P/E) ratio of 6.6, slightly below the industry average of 7.4.

Strong dividend forecast

Based on an average of forecasts from a wide range of analysts, the consensus is that HSBC’s dividend payments will increase in the coming years. In addition to an estimated increase to 8.4% by 2027, HSBC has also promised a special dividend of 21p per share paid out when it sells its Canadian division.

An upcoming dividend of 31p per share will be paid out on 25 April for any shareholders who bought before 7 March 2024. Unfortunately, I missed that ex-dividend date but I plan to get in before the next one.

Risks

The biggest risk the banking industry faces is an economic slowdown or recession, a situation that typically results in loan defaults. It’s no secret that past recessions have led to bank closures.

To evaluate this risk we need to look at the bank’s balance sheet.

As of 30 December 2023, HSBC was estimated to have around £500bn in total debt and only £150bn in equity. This would result in a debt-to-equity (D/E) ratio of 332% – a number preferably kept below 100%. But a more concerning figure is the bank’s allowance for bad loans, which at 57%, is considered insufficient. Ideally, this number should be above 100%.

This puts it at risk of losses if a worsening economy leads to an increase in loan defaults.

Net positive

Despite the risks, I think HSBC has the potential for a net positive outcome to my portfolio. Recent performance suggests the share price could continue to enjoy slow but stable growth from here.

Even in the event of price depreciation, the high dividend yield would help to offset losses. For this reason, I feel confident to add HSBC to my list of dividend shares for my next buying round.